Crisis-Aware Portfolio Risk Model

Built for investors who need to see the invisible. A live, client-side Monte Carlo engine that stress-tests the S&P 500 against COVID-19 and 2008-style shocks in real time.

Live Stress Test

Adjust volatility parameters to shock the marketVaR 95%

0.0%

VaR 99%

0.0%

Expected Shortfall

0.0%

COVID Crash

-34%

*The blue area represents the probability distribution of returns. The fatter the tail (left side), the higher the risk of extreme loss.

The Problem

Standard VaR models often fail during "black swan" events because they assume normal distributions. During COVID-19, correlations between assets spiked to near 1.0, causing diversification to fail exactly when it was needed most.

The Solution

This model uses a "fat-tailed" simulation that blends historical drawdown patterns with adjustable stress factors. It allows risk managers to answer "What if?" questions by manually cranking up volatility and correlation.

Tech Stack

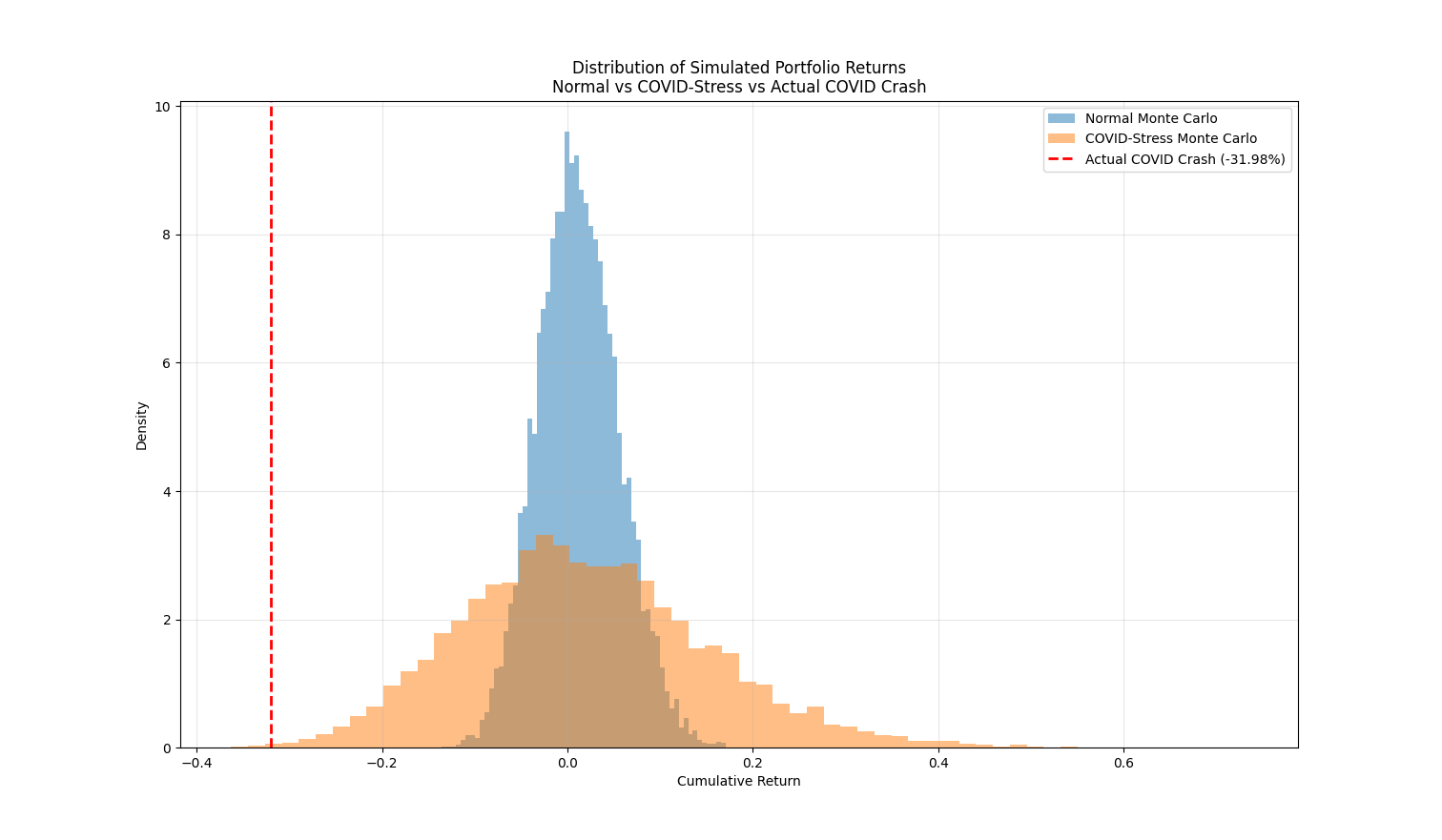

Benchmarking Against Reality

COVID-19’s early-2020 drawdown was a true outlier. Even after inflating volatility and correlations in standard models, the simulated tail often sits above the realized crash. This tool visualizes that gap, proving why stress-testing is critical.

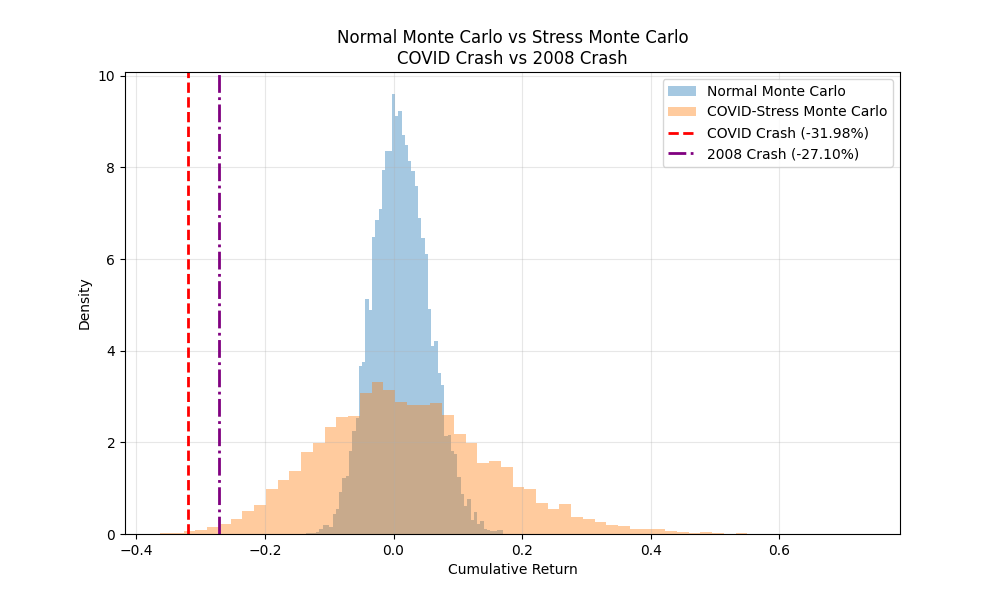

2008 vs. 2020

By overlaying the 2008 Global Financial Crisis, we see a similar pattern: both crashes push beyond conventional 99% VaR. This second view helps contextualize how rare—and devastating—these events truly are.